Understanding GST: A Beginner's Guide for Business Owners

Understanding GST: A Beginner's Guide for Business Owners

Operating a business in India now includes understanding and adhering to GST (Goods and Services Tax). If you are a startup founder, small business owner or head of a big business, GST registration and return filing is compulsory for you. GST is a bit confusing for many new entrepreneurs, and hence this guide is specially crafted for beginners with a simple explanation.

What is GST?

GST is a uniform indirect tax system which was implemented in July 2017. There used to be various taxes such as VAT, Service Tax, Excise Duty, now there is one for all – GST.

It is termed as "One Nation, One Tax" as there is one set of rule and rate to be followed in all states.

Why is GST significant for business owners?

- Simple Tax System – Now eliminate the nuisance of various taxes.

- Input Tax Credit (ITC) – The GST you pay when you buy can be set off with the GST of sales.

- Credibility – Registered business appears professional and credible.

- Easy Business – It is now easy to sell goods and services from one state to another.

Types of GST

Businessmen need to know these 4 types:

- CGST (Central GST): It will go to the Central Government.

- SGST (State GST): It will go to the State Government when sales are occurring within the same state.

- IGST (Integrated GST): When sales are occurring in other states.

- UTGST (Union Territory GST): For Union Territories.

Example:

If selling within Delhi → CGST + SGST.

If selling from Delhi to Maharashtra → IGST.

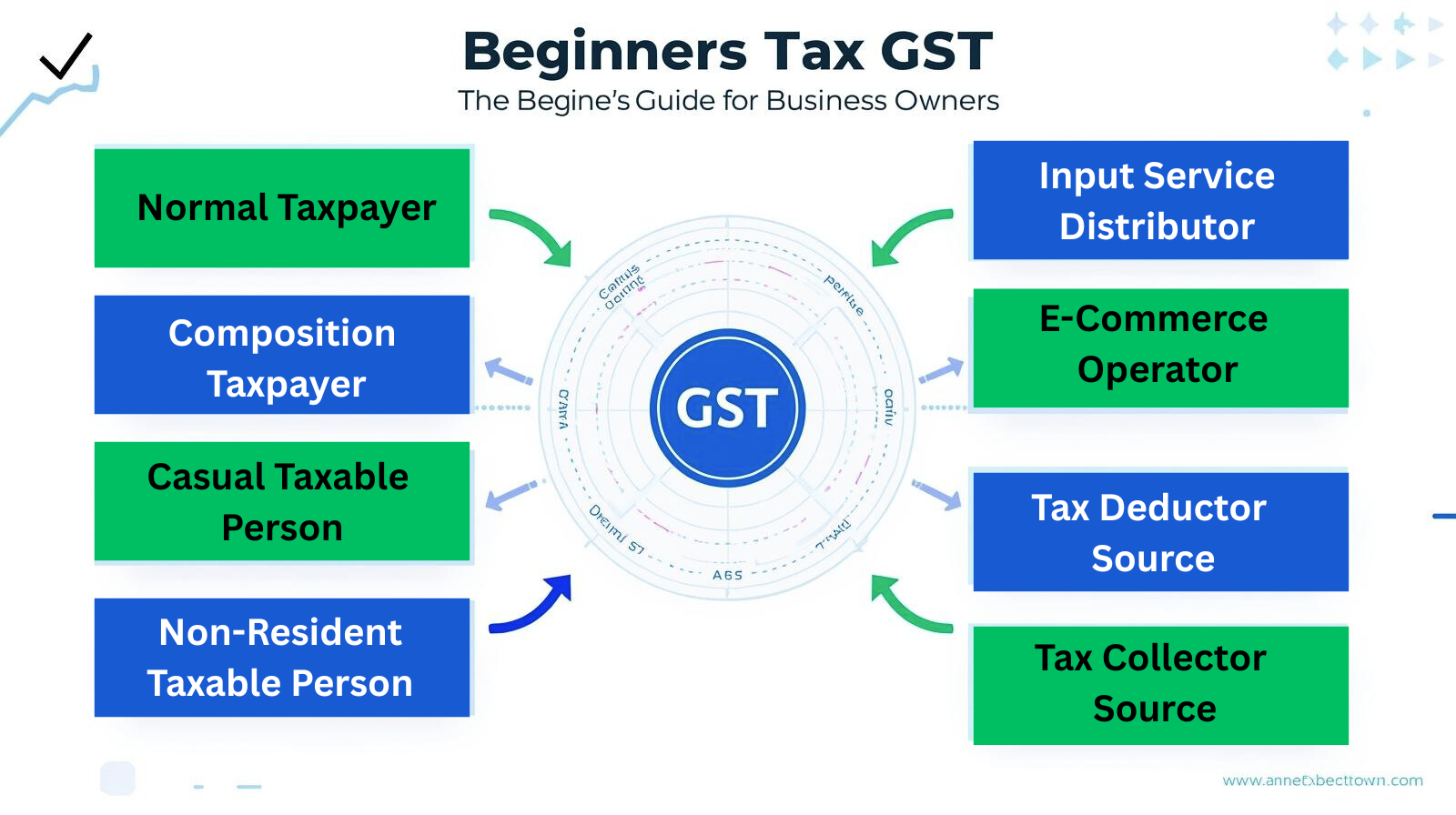

Who should do GST Registration?

It is compulsory for you to register for GST if:

- Annual turnover is ?40 lakh+ (?20 lakh for services) (?10 lakh for special states).

- You are supplying interstate goods/services.

- You are operating an e-commerce venture.

- You are a casual taxable person or non-resident engaged in business in India.

GST Rates in India

GST is classified in various slabs:

- 0% – Fruits, vegetables, milk and such necessary things.

- 5% – Everyday items (sugar, footwear below ?1000).

- 12% – Processed food, computers.

- 18% – Restaurants, telecom, maximum goods & services.

- 28% – Luxury items (cars, soft drinks, tobacco).

GST Registration Process

- Go to GST portal.

- PAN, mobile number, email ID and register.

- Upload documents of business (PAN card, Aadhaar, bank details, address proof).

- You will receive GSTIN (GST Identification Number).

- Then you have to file regular GST returns.

GST Compliance for Business Owners

Issue GST invoice on each sale.

File Monthly / Quarterly / Annual GST returns.

Maintain proper record of purchases, sales and ITC.

Pay GST on time → Penalty is charged on delayed payment.

Benefits of GST for Business Owners

- Relief from multiple taxes

- Transparency and trust is established

- ITC decreases cost

- Interstate trade becomes simple

- Credibility boosts for clients and customers

In present times, knowing GST is essential not only to remain compliant, but also to save expense and operate the business effectively. If you feel filling is complicated, then seeking assistance from a CA or tax advisor is the best option, so that you can concentrate on hassle-free business growth.

Share With Us